How I *Could Have* Built a Full Retirement Nest Egg at Age 18

A simple decision to go to community college would have made all the difference.

For my freshman year of college, I shelled out $27,000 on tuition and housing to go to a 4-year state school. I was 17-years-old when I made that decision.

After I realized I had no idea what I wanted to study, I opted to go to community college in my sophomore year. That saved me quite a bit of money. It only cost me a little over $2,500.

That’s a difference of $24,500.

In my sophomore year, I was lucky enough to live with my parents which saved me big time on rent. While not living the traditional college experience, I also found more time which allowed me to pick up some part-time work. I was earning about $1,000/month working for the city parks service. That totaled $12,000 in extra income for the year.

When I account for the extra income I was earning, I calculate it as a $36,500 expense swing between one year at a state school and one year at a community college.

Now, let me tell you why I wish the standard procedure would be to go to community college straight out of high school.

Building a retirement fund in one year

Imagine if the norm was to attend a community college in your first year of school. Just the first year.

Now, imagine you’re required to put the money you saved into a retirement account at 18-years-old. And leave it there for the next 45–48 years.

Assuming you saved what I did ($24,500) and earned $1,000 extra each month in income from a part-time job, you’d be looking at a good chunk of change after all those years compounding on the market.

Even by conservative estimates, you could very likely have a full-on retirement nest egg derived from one decision. Your decision to attend community college at 18.

I know this idea isn’t foolproof for everyone. Most 18-year-olds rely on student loans to get them through their first year of college anyway which means they wouldn’t have the money to invest in the first place — even if they went to community college.

This is just an example to show you how critical our choices at the beginning of our adult lives were/are.

What if I had started a retirement fund at 18 instead?

I was fortunate enough to have saved nearly $20,000 before my freshman year of college. My parents took care of the rest of my tuition bill which means I didn’t have to take out a loan my first year. I was very lucky.

However, my first year of school still completely decimated my entire life savings. It isn’t until later that I asked whether it was worth it or not.

Let’s take a look at the numbers.

Assuming I saved the $20,000 I had before attending state school; and my parents covered the cost of my community college tuition (which they did); all while saving $12,000 from a year of part-time work;

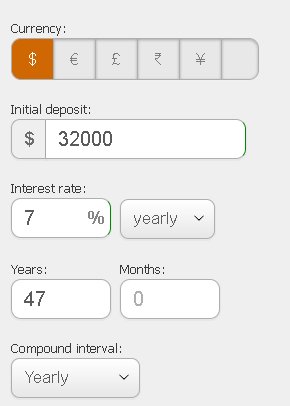

I’d have $32,000 to invest.

Note: This is all hypothetical. The last thing I was thinking about at 18 was my investments. But let’s play with some numbers just for shits and giggles.

In this example, let’s assume a retirement age of 65. That gives us 47 years of compounding interest. That’s a hell of a lot of time to compound.

Then, let’s rely on stock market averages and history to grant us a 7% return over the course of that time.

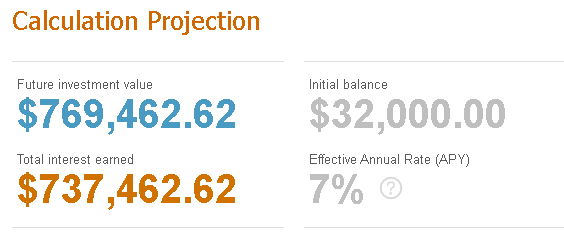

$32,000 invested over 47 years at a 7% yield will eventually lend itself to a final portfolio balance of $770,000.

Are you kidding me?

That’s a retirement fund I could’ve built in one year at 18-years-old. Why doesn’t our education system teach us these kinds of things?

I realize not everyone has this kind of opportunity. But it is a damn shame that those who do aren’t being taught to take full advantage of it.

Even at 18, if somebody stuck these numbers in front of me, I think I would’ve been all-in.

Developing new norms for higher education

Rising tuition fees have placed a massive plague on today’s debt counter. Even if this isn’t a realistic demonstration for everyone, it still goes to show you the opportunities we have at 18 and how forking out thousands of dollars at such a young age is almost always the wrong choice.

Of course, there will always be arguments for a college degree and I am certainly not against the idea. But, I’m saying our system and norms now deserve wiser consideration.

Instead, let’s give 18-years-olds a plethora of choices beyond furthering their education right away. Doors are truly wide open at that age and it’s a shame that a college education has basically become a prerequisite to starting adult life.

What’s the harm in getting a college degree at, say, age 28? Why does one of our biggest decisions in life have to be made at a time when we understand nothing about the bigger picture?

Yes, I’m ranting. But when I think about the opportunities that closed on me the second I forked over my freshman year tuition payment, I can’t help but make some noise. Why aren’t adults speaking to high school students about alternative ideas?

What do you have to say about this? Do you like my one-year retirement fund example? Does it make sense to anyone else?

Connect with Me:

Work with Me // Newsletter // LinkedIn // Twitter // Amazon // Pinterest

Join my FREE 5-Module Medium Crash Course for Early Success!

Read More:

- The College Degree is Dead

- My Biggest Financial Mistake was Graduating from College

- The American Dream Has Been Cancelled

Originally published at https://www.adamcheshier.com/ on May 1, 2021.