How I Retired in 5 Years on a $20,000 Salary

And how you can do it even faster and better.

This year, I can retire at age 27.

I’m not trying to brag, I just needed a one-liner to grab your attention. But everything I’ll say from here on out is completely true and attainable. It takes a willingness to stay committed to your financial plan, some sacrifice on your living condition, and, I’ll admit, a touch of luck.

I know this advice won’t be for everyone, but if you’re dealt the right cards — why not?

I graduated in 2016 and went straight into freelancing. It wasn’t what I intended to do, but I couldn’t see myself doing anything else, either.

I began writing a blog that landed me a few clients and sooner or later, I was pulling in around $20 thousand a year. It’s nothing to write home about, but I was damn proud that I was able to manufacture that income myself.

Also, my freelancing career only had me working about 40 hours a month. My work schedule was not too strenuous. So, I had plenty of time to research frugal living and alternative lifestyles.

After all, it is pretty difficult to live on $20k per year if you don’t have the right budgeting in place.

The impossibility to save

I’m a lifelong saver. I pride myself on my money decisions and if I wasn’t saving more money than I was spending, I’d feel pretty bad about it.

As you can imagine, I quickly realized saving would be impossible on my salary. For any conventional American lifestyle. I had to make drastic changes to my situation — either by making more money or by somehow cutting my expenses.

I was already living on less than $15,000 per year which, by anyone’s standards, is pretty frugal for a United States resident. I couldn’t figure out how to cut expenses more than I already had unless I moved into a van down by the river.

While I wasn’t completely ruling that possibility out, I wasn’t quite ready to commit to it. So, maybe I could increase my salary.

Building your own freelancing career doesn’t happen overnight. You have to appreciate the gradual gains. I viewed my $20k salary as monumental. Plus, I was still getting used to the business. I didn’t want to rush things.

It’d take years before I could afford the U.S. as a content writer.

So, I looked elsewhere. And, researching the cost of living in other corners of the world, I came up with a financial strategy.

Geo-arbitrage for digital nomads

Geo-arbitrage is a movement I came across while building a new financial plan. It’s the idea that one can move to a place where his/her money goes further.

I understand the questionable ethics behind it. Especially when moving to a third-world country from a more developed nation. It’s not the perfect solution and I’m not here to brag about how you can live like a king on a low-income salary. That wasn’t my idea.

Instead, I planned to cut my expenses as much as possible. Which meant immersing myself in the locals’ world. I figured if I reminded myself of my financial goals every day, I would also minimize the potential harm of geo-arbitrage.

Instead of moving to Bali to rent a luxurious villa, I would find a humble local home. I would contribute to the local economy instead of spending in foreign-owned businesses. I would be aware of every aspect of my impact and would continue to keep myself in check. It’s the only way I could justify going against my ethics.

So, I moved to Southeast Asia.

By the numbers

Let’s take a look at the effectiveness of this strategy. . .

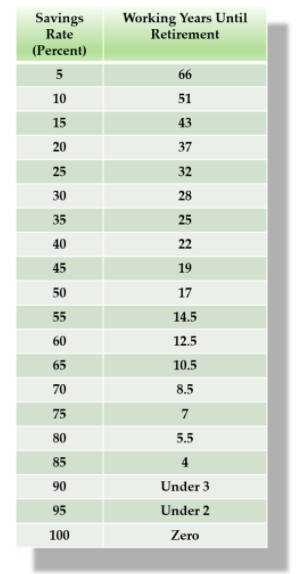

In the United States, I was lucky to save 25% of my salary. Which, when only making $20k, is damn good. Still, applying the education I learned from the F.I.R.E. movement (Financially Independent, Retire Early) to my situation, I wouldn’t have been able to retire for 32 years.

Instead, I was saving nearly 80% of my income in Southeast Asia which would allow me to retire in 5.5 years.

This was key in allowing me to get retirement funds established. Every penny I saved, I stuck into the stock market or other investment assets.

A little bit of luck

If you follow along with the F.I.R.E. movement, you know the way retirement time frames are calculated is by analyzing current living expenses and projecting them into your future retirement.

By this rule, I would have to live at a Southeast Asian expense-level the rest of my life if I wanted to retire in 5.5 years.

How I was able to change this is by getting a little lucky with my investments. However, it wasn’t all luck. My investment strategy was intentionally aggressive. I played with a lot of risks.

I had a one-track mind and that was to achieve my goal of financial independence as soon as possible. All I needed was a little bit of capital so I could risk it all.

Luckily, it paid off. It grew to an amount that I can safely live off of in the United States using high-interest savings rates on DeFi systems. I’ll be writing more about this technique in the future, too.

Not your traditional retirement

By rushing into ‘retirement’, I’ll have to be rather frugal for many years before my nest egg grows to a comfortable situation. To combat that, I am not launching myself into a typical retirement. I won’t cut out my client’s work cold-turkey.

I’d rather pride myself on ‘financial independence’ rather than retiring early.

Instead, I’ll continue writing for the clients I enjoy working with for a few more years. I’d get bored if I quit everything today anyway.

Instead of traditional retirement, I’ll take the ‘win’ in knowing I can retire at any time and live a lifestyle that is conducive to me. But I won’t actually retire. Like I said earlier, I enjoy saving. It gives me a sense of purpose.

So, sorry if my headline is misleading. I’m not actually retiring in a traditional sense. Although, I am taking a load off. But I know an extremely frugal lifestyle isn’t for everyone. But, I’m just telling my story.

If you are on your journey to financial freedom, let me hear about it! What challenges are you facing and what techniques have you taken?

Join my FREE 5-Module Medium Crash Course for Early Success!

If you found this article engaging, hit the clapper button to help me out.

Connect with Me:

Work with Me // Newsletter // LinkedIn // Twitter // Facebook // Pinterest

** This article was originally published at www.adamcheshier.com **

Read More:

4 Ways to Grow Into a Real Traveler

The travel that you won’t find on an Instagram feed.